Accounts Payable - Post Invoices

The Accounts Payable Post Invoices routine allows the user to enter Invoices into the system. As Invoices from Vendors come into the Firm, they must be entered into the system to ensure they will be properly tracked and to keep payable balances up to date. Vendors are those people or companies that provide the Firm with a product or service. Invoices can consist of expenses incurred on behalf of a Client (for which the Client will likely be billed for at a later date), expenses incurred by the Firm itself, or a combination of the two.

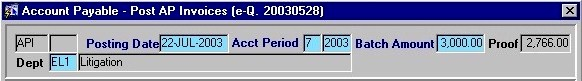

When the AP Post Invoices routine is accessed from the eQuinox main menu, the screen shown below will be displayed.

Field Definition

The first two fields on this screen display the Journal Type (API) and the Journal Number.

Posting Date - The date on which the Invoice is being posted. This field automatically defaults to the current system date.

Acct Period - The Month (in number format) and Year of the Firm's current Accounting Period. This field automatically defaults to the current Accounting Period. Note: Depending on the Firm's preferences (as indicated in the Firm Parameters routine), the user may be alerted with a message when posting the Invoices, and asked to verify the Accounting Period; this is used to ensure that all transactions occur within the correct Accounting Period.

Batch Amount - The total amount (in dollars) of Invoices to be entered in the current Journal. If known, this number may be entered when the Journal is started, or when posting the Journal.

Proof - The amount of the 'Batch' that is left to be applied (i.e. The Batch amount minus the actual amount of Invoices currently in the Journal). The Invoices cannot be posted until the Proof amount equals zero.

Dept - The name and unique identifier of the Department in which the expense was incurred. A selection may be made from the List of Values provided in the Dept field. This field defaults to the current Department.

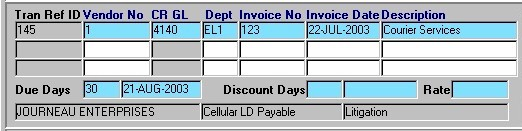

Invoice And Vendor Information

The following screen sections are used to enter Invoice and Vendor details. Once the general Invoice information has been entered, the user must then enter the Invoice detail information (i.e. the Client and/or Firm Expense records) which explain the way in which the Invoice expense was incurred. Each Invoice can consist of multiple Client Expense and multiple Firm Expense records.

Tran Ref ID - The Transaction Reference Identification number. This number is automatically assigned by E-Quinox, and is used to identify the Transaction, not the Invoice itself.

Vendor No - The unique identifier of the Vendor associated with the current Invoice (i.e. the Vendor who sent the Invoice to the Firm). A selection may be made from the List of Values provided. The Vendor No will be displayed in this field, and the Vendor Name will be displayed below (i.e. "Journeau Enterprises").

CR GL - The number of the General Ledger Account that will be credited when the Invoice is paid. This Account number is automatically displayed when the user selects the Vendor in the previous field (i.e. each Vendor is associated with a specific General Ledger Account). The corresponding GL Account name is displayed below (i.e. "Cellular LD Payable").

Dept - This field automatically defaults to the Department with which the current user is associated (identified when the user logs into the system). If necessary, this can be changed by making a selection from the List of Values provided. The Department name is displayed along the bottom of this section of the screen (i.e. Litigation).

Invoice No - The Invoice number, as appears on the Invoice itself. This number must be manually entered by the user.

Invoice Date - The Invoice date, as appears on the Invoice itself. This field defaults to the current system date, but may be changed by making a selection from the Calendar provided.

Description - A description of what the invoice is for (i.e. Computer Hardware Upgrades, Internet Service Provider, Catering of Staff Party), or any other important Invoice information that the user may wish to record.

Days Due - The number of days within receipt that the balance outstanding is due. This number is automatically displayed, and defaults from the Vendor level. The date on which the Invoice is due is also calculated and displayed.

Discount Days - The number of days within which an Invoice must be paid to receive a discount on the next Invoice from this Vendor. This number is automatically displayed, and defaults from the Vendor level. The date on or before which the Invoice would have to be paid to receive a discount is also calculated and displayed.

Rate - If the Invoice is paid within the number of Discount Days, the discount at the Rate displayed in this field will be applied to the next Invoice from the current Vendor.

Invoice Amt - The Invoice Amount before tax, as indicated on the Invoice itself. A running total of the amount for all Invoices entered is displayed below this field.

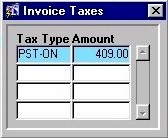

Tax Amt - When the user enters this field, they are presented with the window seen below (Invoice Taxes). The user must select the Tax Type and enter the Amount. A running total of the tax amount for all Invoices entered is displayed below this field.

Total Invoice - The total amount being charged to the Firm for the current Invoice. Once the user enters the Tax Amount, the Total Invoice amount is automatically calculated. A running total of the total invoice amount for all Invoices entered is displayed below this field.

AP Tax - When the user clicks this button, they are again presented with the window seen below (Invoice Taxes). This allows the user to verify the Tax Type and Amount, or to make any necessary changes.

Inv Proof - A running total of the amount of the Total Invoice that has been applied (i.e. the sum of the Client Expense records and Firm Expense records for the current Invoice). Note: The Invoice cannot be posted until the Total Invoice and Current Invoice Proof figures are the same.

The window seen on the left is accessed in two ways; when the user enters the Tax Amount field, or when the user clicks the AP Tax button.

Tax Type - The type of Tax applied to the Invoice Amount. A selection may be made from the List of Values provided.

Amount - The amount of tax on the current Invoice. This figure must be manually entered by the user.

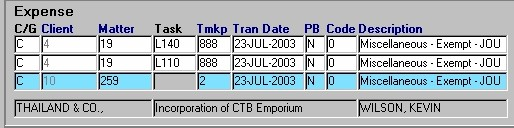

Client Expense Records

Invoices can consist of Client Expenses, Firm Expenses, or a combination of both. Expenses incurred on behalf of a Client are recorded as Disbursements, and will likely be billed to the Client. The Expense section of the screen, seen below, displays information pertaining to the portion of an Invoice that consists of Client expenses (also known as General Disbursements or Hard Costs).

C/G - If the current record is a Client Expense record, the user must enter "C" in this field and then continue to the remaining fields in this section. If the current record is a Firm Expense/GL record, the user must enter "G" in this field; the user will then be taken to the Firm Expense section of the screen where they must continue.

Client - The unique identifier of the Client associated with the Invoice expense (i.e. the expense was acquired through work for this Client). When entering new Client Expense records, the Client may be selected from the Look-Up form provided. The Look-Up form will display all Clients, and all Matters associated with each Client. The Client Name is displayed below (i.e. "Cruise, Nicole")..

Matter - The unique identifier of the Matter associated with the Invoice expense (i.e. the expense was acquired through work on this specific Matter). This field will be filled automatically with the information from the selection made in the Client field. If this value is incorrect, another Matter for the current Client may be selected from the Look-Up form provided.

The Look-Up form will display all Matters associated with the Client displayed in the Client field. The Matter Name is displayed below (i.e. "Default Matter Name").

Task - The Task Code associated with the current Client Expense record. Here, Task Codes are used to identify the type of activity through which the Invoice expense occurred. When entering new records, a selection may be made from the List of Values provided. This feature is used in conjunction only with those Matters which are Billed on a Task Basis (a Task Template must be assigned in the Maintain Matter Information routine). If a Matter is not Billed on a Task Basis, this field will be left blank.

Tmkp - The unique identifier of the Timekeeper associated with the current Invoice expense (i.e. usually the Timekeeper who is responsible for the Matter). When entering new records, a selection may be made from the List of Values provided. The Timekeeper Name is displayed below (i.e. "Chappel, Max").

Tran Date - The Transaction Date (i.e. the date on which the expense was incurred). When entering new records, a selection may be made from the Calendar provided. If the user tabs through this field without entering a value, it automatically defaults to the current system date.

PB - The value displayed in this field indicates whether or not the current record is a priority bill (i.e. "Y" indicates Yes, "N" indicates No). When entering new records, this field defaults to "N". To change this, the user must manually enter "Y".

Code, Description - The code and description of the Disbursement through which the Client Expense portion of the Invoice expense was incurred. A selection may be made from the List of Values provided.

The fields that run along the bottom of the Client Expense section display the Client Name, Matter Name, and Timekeeper Name for the current Client Expense record.

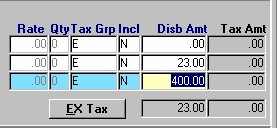

Rate - The amount charged for one unit or occurrence of the current type of Disbursement. This field is automatically filled with the proper information when a selection is made from the Disbursement List of Values.

Qnt - The quantity or number of occurrences of the current Disbursement. If the user tabs through this field without entering a value, it will automatically default to '1'.

Tax Grp - The tax group applied to the current Client Expense Disbursement amount. A selection may be made from the List of Values provided.

Incl - The Yes/No value of this field indicates whether or not the Tax Amount is to be included in the amount charged for the current Client Expense Disbursement. When entering new records, this field defaults to "N" (No). To change this, the user must manually enter "Y".

Disb Amt - The total amount being charged to the Client for the current Client Expense Disbursement. A running total of the disbursement amount for all Client Expense records entered is displayed below this field.

Tax Amt - The amount of Tax that is to be charged for the current Client Expense Disbursement. This amount is calculated based on the Rate, Quantity, and the rate of the Tax Group being applied. A running total of the tax amount for all Client Expense records entered is displayed below this field.

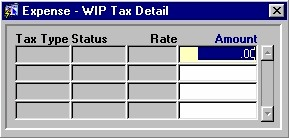

EX Tax - When the user clicks this button, they are presented with the window seen below (Expense - WIP Tax Detail). This allows the user to verify the tax information for the current record.

Tax Type - The type of Tax applied to the current Client Disbursement.

Status - The status of the Tax Type (i.e. Taxable, Exempt).

Rate - The rate at which Tax is charged for the current Tax Type.

Amount - The dollar amount of Tax charged for the current Client Disbursement.

Firm Expense Records

Invoices can consist of Client Expenses, Firm Expenses, or a combination of both. As Client Expenses, Firm Expenses are recorded as Disbursements. This section of the screen displays information pertaining to the portion of an Invoice that consists of Firm Expense/GL Disbursements (also known as Sundry Disbursements or Soft Costs).

C/G - If the current record is a Client Expense record, the user must enter "C" in this field; the user will then be taken to the Expense section of the screen where they must continue. If the current record is a Firm Expense/GL record, the user must enter "G" in this field and then continue to the remaining fields in this section.

DR GL - The General Ledger Account that is to be Debited during the current Disbursement Transaction. A selection may be made from the List of Values provided. The Account Number is displayed in this field and the Account Name is displayed below (i.e. "Bank - General").

Dept - The unique identifier for the Department associated with the current Firm Expense Disbursement (i.e. the department within which the expense was acquired). This field automatically defaults to the Department/Office indicated by the Department field in the first section of the screen. If necessary, this value may be changed by making a selection from the List of Values provided. The Department ID is displayed in this field and the Department Name is displayed below (i.e. "Litigation").

Tmkp - The unique identifier for the Timekeeper associated with the current Firm Expense Disbursement. A selection may be made from the List of Values provided. The Timekeeper ID is displayed in this field, and the Timekeeper Name is displayed below (i.e. "Wilson, Kevin").

Tran Date - The date on which the Disbursement expense was acquired by the Firm. When entering new records, a selection may be made from the Calendar provided. If the user tabs through this field without entering a value, it automatically defaults to the current system date.

Market Event - The marketing event, if any, that is associated with the current Firm Expense record. A selection may be made from the List of Values provided.

Code, Description - The code and description of the Disbursement through which the Firm Expense portion of the Invoice expense was incurred. A selection may be made from the List of Values provided.

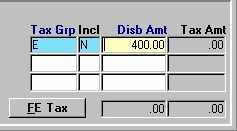

Tax Grp - The tax group applied to the current Firm Expense Disbursement amount. A selection may be made from the List of Values provided.

Incl - The Yes/No value of this field indicates whether or not the Tax Amount is to be included in the amount charged for the current Firm Expense Disbursement. When entering new records, this field defaults to "N" (No). To change this, the user must manually enter "Y".

Disb Amt - The total cost to the Firm for the current Firm Expense Disbursement. A running total of disbursement amounts for all Firm Expense records entered is displayed below this field.

Tax Amt - The amount of Tax that is to be charged for the current Firm Expense Disbursement. A running total of the tax amount for all Firm Expense records entered is displayed below this field.

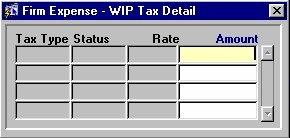

FE Tax - When the user clicks this button, they are presented with the window seen below (Firm Expense - WIP Tax Detail). This allows the user to verify the tax information for the current record.

Tax Type - The type of Tax applied to the current Firm Expense Disbursement.

Status - The status of the Tax Type (i.e. Taxable, Exempt).

Rate - The rate at which Tax is charged for the current Tax Type.

Amount - The dollar amount of Tax charged for the current Firm Expense Disbursement.

To post a Batch of Invoices, the user must click the Save button. When the Invoices are successfully posted, the user will be presented with the message seen on the left.